Which lenders will accept rent as genuine savings?

Dale Henry • Mar 01, 2023

Saving a deposit can be a challenge these days. So is there a workaround and can rent be used as genuine savings?

When you’re looking to buy a home in Australia, one of the key requirements from lenders is genuine savings. Genuine savings refers to the amount of money you have saved in a bank account over a certain period of time, which can demonstrate to lenders that you are financially responsible and can afford to make repayments on a home loan.

However, not everyone has the luxury of being able to save up a significant amount of money over time. That’s where rent might come in as a form of genuine savings. In this blog post, we’ll explore which lenders accept rent as genuine savings and what you need to know to maximize your chances of getting approved for a home loan.

So, what qualifies as genuine savings?

Before we dive into the topic of using rent as genuine savings, let’s first take a closer look at what genuine savings actually means. Genuine savings are defined as funds that have been accumulated over time through regular deposits and saved in a savings account, term deposit, or other investment account. These funds must be held for a specific period of time, typically at least three months, and can’t be borrowed funds or gifted funds from family or friends.

Lenders require genuine savings because it demonstrates that you have the ability to save money over time and are financially responsible. It also shows that you have some equity in the property you’re purchasing, which can reduce the lender’s risk. Lenders will typically require a minimum percentage of the purchase price to be held in genuine savings, which varies depending on the lender and the loan product.

Examples of genuine savings include:

- Savings held in a bank account or term deposit

- Equity in existing property

- Shares or managed funds

- Superannuation funds

- Inheritance received

How do lenders view rent as savings?

So, can you use rent as proof of savings? Now that we understand what genuine savings are, let’s look at how rent can be considered genuine savings.

Some lenders will accept rent as genuine savings if you can demonstrate that you have consistently paid your rent on time for a specific period of time, typically at least 12 months. However, not all lenders will accept rent as genuine savings, and even those that do may have different criteria and requirements.

Factors that lenders consider when accepting rent as genuine savings include:

- Consistency: Lenders will want to see that you have paid your rent on time consistently over a certain period of time.

- Amount: Lenders will typically only consider a certain percentage of your rent payments as genuine savings, usually around 80%.

- Documentation: You will need to provide evidence of your rental payments, typically in the form of rental receipts or a rental ledger from your landlord or property manager.

Examples of when rent is not considered genuine savings include:

- If you’re renting from a family member or friend

- If you’re renting a room in someone else’s home

- If your rental payments have been irregular or inconsistent

It’s important to note that even if you do have rent as genuine savings, it may not be enough on its own to meet a lender’s genuine savings requirement. You may need to also have some funds held in a bank account or other investment account to meet the minimum genuine savings requirement.

Which lenders accept rent as genuine savings?

It’s important to note at this point that not all lenders will accept rent as genuine savings as a point of policy and policy may change at any time. Lenders may and do have different criteria and requirements and approval is always a result of an assessment of your individual situation.

Some of the lenders that accept rent as genuine savings include:

- ANZ: ANZ may consider rental payments as genuine savings if you have been renting for at least six months and can provide evidence of your rental payments.

- Westpac: Westpac may consider rental payments as genuine savings if you have been renting for at least 12 months and can provide evidence of your rental payments.

- NAB: NAB may consider rental payments as genuine savings if you have been renting for at least six months and can provide evidence of your rental payments.

- Commonwealth Bank: Commonwealth Bank may consider rental payments as genuine savings if you have been renting for at least 12 months and can provide evidence of your rental payments.

- St George: St George may consider rental payments as genuine savings if you have been renting for at least 12 months and can provide evidence of your rental payments.

Again, it’s very important to note that each lender may have different criteria and requirements for accepting rent as genuine savings.

For example, some lenders may require that the rental payments have been made on time every month, while others may only consider a percentage of the rental payments as genuine savings. It’s super useful to speak with a mortgage broker or lender directly to understand their specific criteria for accepting rent as genuine savings.

Tips for using rent as genuine savings

If you’re investigating using rent as genuine savings, here are some tips to maximize your chances of getting approved for a home loan:

- Keep good records: Keep track of your rental payments by saving your rental receipts or requesting a rental ledger from your landlord or property manager. Make sure you have evidence of all your rental payments to provide to the lender.

- Be consistent: Make sure you have consistently paid your rent on time for the required period of time. If there have been any missed or late payments, be prepared to explain the circumstances to the lender.

- Have other genuine savings: Even if you do have rent as genuine savings, it may not be enough on its own to meet the lender’s genuine savings requirement. Make sure you have some funds held in a bank account or other investment account to meet the minimum genuine savings requirement.

- Speak with a mortgage broker: A mortgage broker can help you understand which lenders accept rent as genuine savings and can help you find the best home loan product to suit your needs.

Alternatives to rent as genuine savings include:

- Savings held in a bank account or term deposit

- Equity in existing property

- Shares or managed funds

- Superannuation funds

- Inheritance received

Can you use rent as proof of savings?

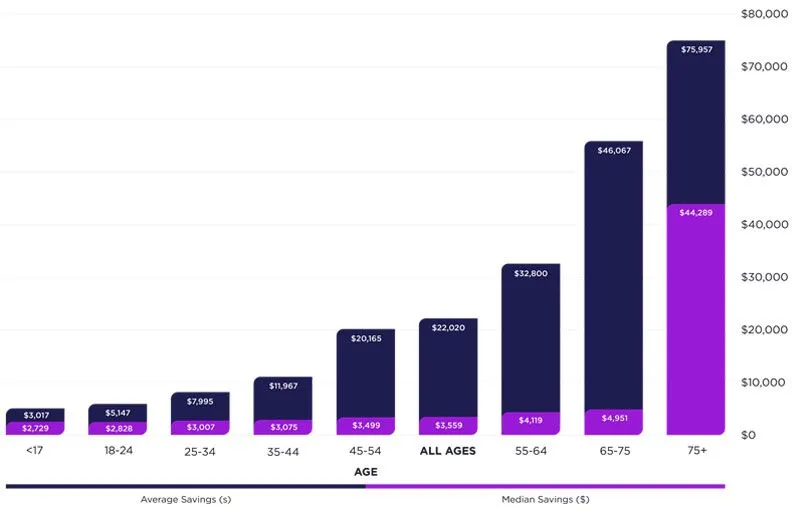

Before we conclude here we think it’s important the following point: where there’s a will there’s almost always a way. You’ll hear us repeat this ad nauseam across this blog but it’s a valid point. Have a look at the chart below which represents the median savings balance for Australians categorized by age group.

Not everyone is floating in cash. This is a big part of why lenders exist in the first place.

So, in principle, yes, rent can be used to contribute towards serviceability by some lenders. Not all lenders will accept it and most if not all lenders will require at least some cash balance equal to around 5% of the total loan.

But where there’s a will, you can get there. And we want to help!

If you’re considering using rent as genuine savings, make sure you keep good records, are consistent with your rental payments, and have other genuine savings to meet the lender’s requirements.

Most importantly, speaking with a mortgage broker can help you find the best home loan product to suit your needs. Remember, while rent as genuine savings may be an option for some, it’s not the only option, so explore all your options to find the best solution for your individual circumstances.

Let us help you!

At Mortgage Haven, we understand that navigating the home loan process can be overwhelming, especially when it comes to meeting the genuine savings requirement. That’s why we’re here to help. Our team of expert mortgage brokers can guide you through the process and help you find the best home loan product to suit your needs.

We have access to a wide range of lenders, including those that accept rent as genuine savings, and can provide you with personalized advice and support every step of the way. Contact us today to find out how we can help you achieve your dream of owning a home.